HOW?: #3 - Portfolio Modeling and Testing

Crypto portfolio model that can give you peace of mind

Classify Your Portfolio

Invest in experimental (6% max), short (20%), long term (30%) and fixed assets (40%). Allocate money appropriately. It is the $ amount across these that matters, not number of stocks etc.

How Much to Invest in Crypto?

General investing guideline is not to exceed 6% of your entire wealth into Crypto. This is considering your investments in home (equity portion only) and other real-estate as well.

If you lose, you won’t feel bad. But the returns are great 10000%.

How to Test if You Invested the Right Amount?

Investing more than you can stomach

Are you not able to sleep at night without thinking about your investments?

Are you checking your portfolio every few hours?

Are you adjusting your portfolio every few weeks or less?

If you answered yes, this is a good sign that you have invested more or you haven’t invested with conviction like Warren Buffett. Here are the things you can do:

Gain more knowledge on the things you invested in to see if you still believe those

If you are not convinced, then transfer to other assets that are less risky but may return less.

Final resort, exit that asset and take profits when relative strength index (RSI) is in overbought level to maximize your returns. (See my tools blog and get TradingView app and watch tools & technical analysis video playlist).

Investing Less

Just put yourself in 10yrs from now and think about the price of that asset and see if you would feel that you had invested less. Ex: Based on the current valid predictions by S2F model, BTC price in 10yrs is going to be a ridiculous $10M. (I know, if someone told you in 2009 when BTC $0.1 that it will be $60k in 10yrs, would you have believed them?)

Understand the Crypto Market & Risk Profile

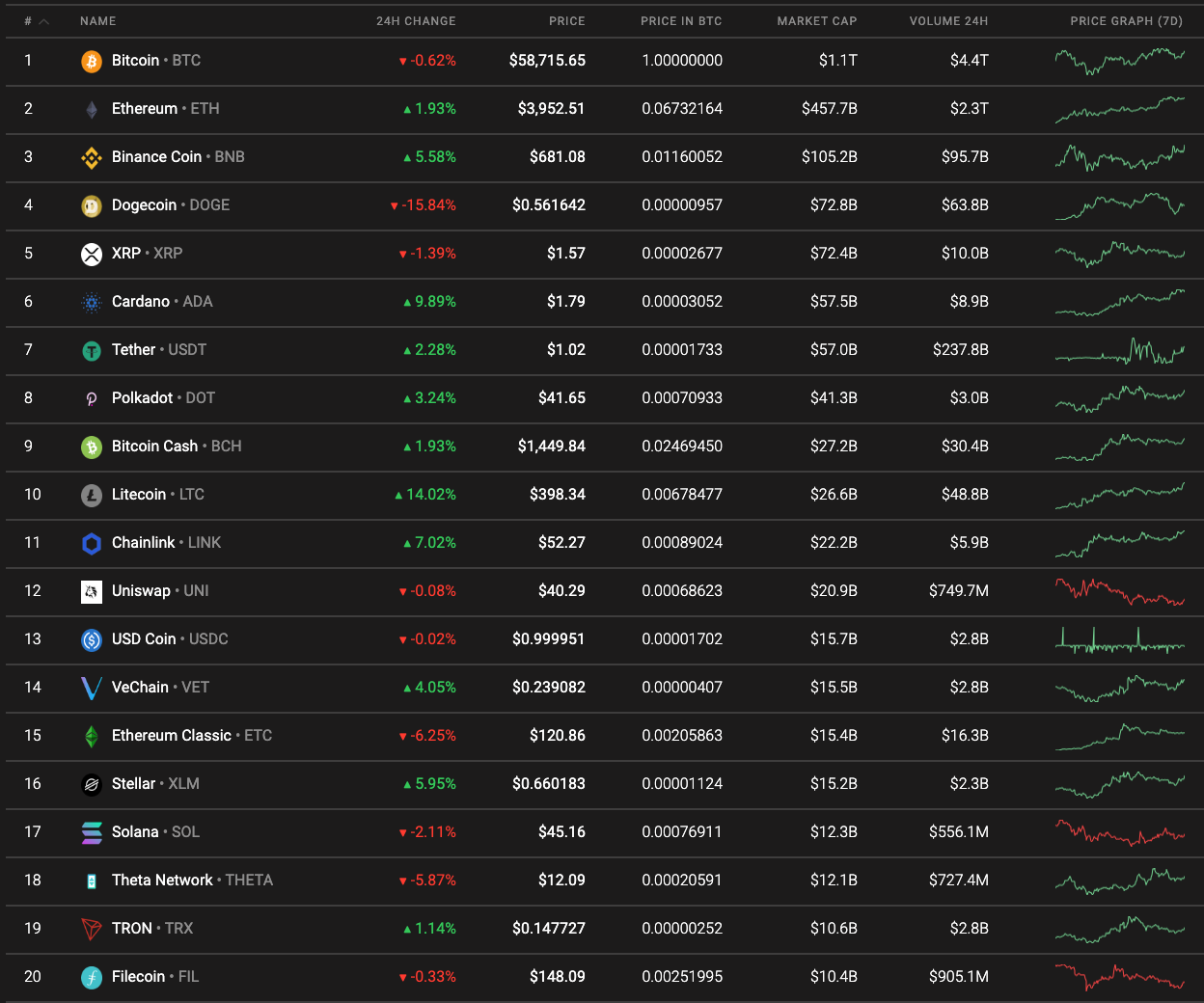

Just like stocks, Crypto is also broken down into Large Cap, Mid Cap, and Small Cap. Each have different dynamics and they work in relation to the other. (Will add new positing on how they move relative to each other)

Market Cap = Total Current Coins Supply * Price

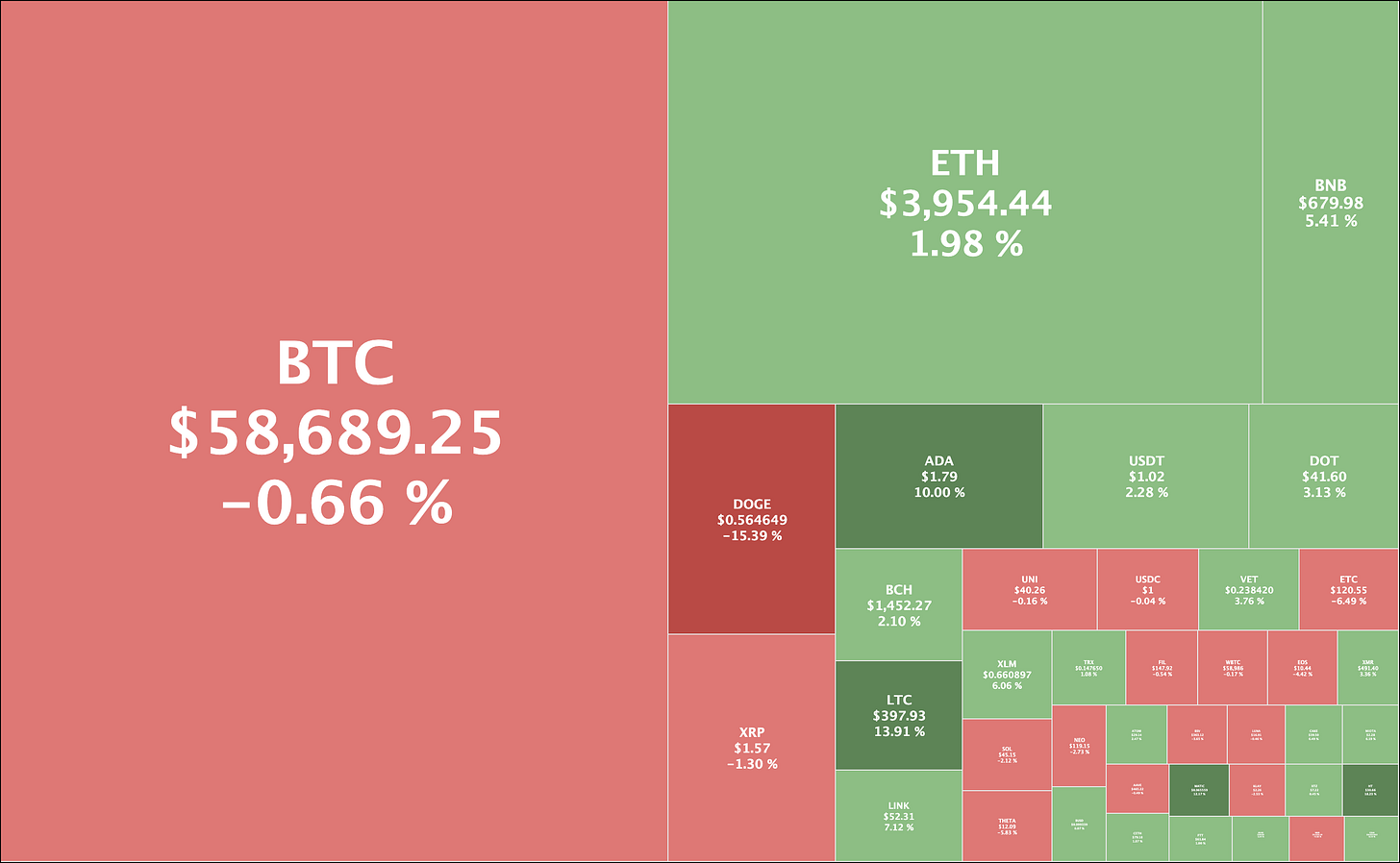

Market Cap visualization

The bigger the box, the bigger the market. Did you see that BTC is ~half of all the Crypto market and ETH is ~30% and then BNB ~10% of the entire market.

Volume and Market Cap

The bigger the market cap, the more volume it has, i.e, less volatility. Low market cap, high volatility.

Important: **** It is unlikely that none of the tokens market cap is going to exceed that of the Bitcoin in near time.

You need to allocate based on the cap, putting more to large cap, then a little less in mid cap, then a smaller portion in low cap, and a tiny fraction on micro cap.

Large Cap

Usually top 3 coins come under this bucket. Ex: BTC, ETH, BNB.

Bitcoin (BTC) is an Asset - This is very unique limited supply token (scarcity principle - Read Crypto why: #1). This is seen as a hedge against deflation. Thus requires a different allocation percentage. You can HODL for a long time. Don’t trade this much and pay only long term tax by holding more than 1 yr.

Ethereum (ETH) is a token for general purpose blockchain - This is inflationary now; with ETH2 release in summer 2021, this will become deflationary - many take over Bitcoin.

Binance (BNB) - Trading platform token. Gets trading fees and early investments in other crypto projects.

Mid Cap

Usually top 4-20 coins that have more than a Billion market cap.

Low Cap

Anything beyond 20 and less than a Billion.

Coin Rankings: coinmarketcap.com

Micro Cap

These are new projects that you may have heard of that have a market cap of a $1M with a million token supply (price shouldn’t matter).

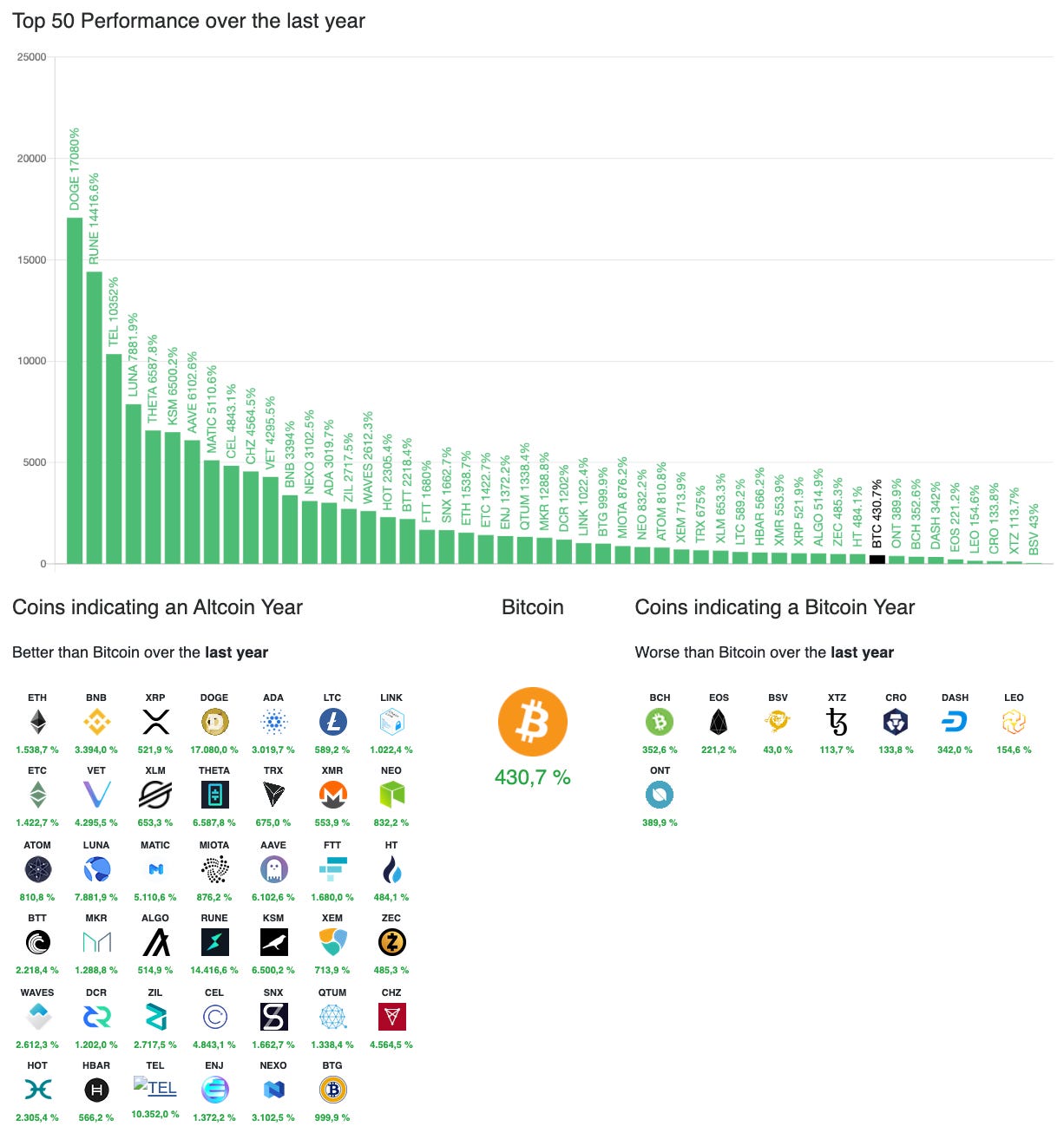

It can go up multifold (theoretical max of 1000,000x), i.e, not to cross Bitcoin market cap.

Hypothetically, if you invested a $1000 and it was hugely successful and went hyperbolic 1000x or (100000 %), you will end up with a Million dollars!

BTW - AAVE went up by this % in the last year.

Model Your Crypto Portfolio

Create a portfolio based on the model portfolio. Watch other successful people’s portfolios to replicate. DO NOT replicate those very popular ones like BitBoy, you will get burned; this is called pump and dump.

I had the first hand experience, once he releases a new video, a million followers will rush to buy those driving the price high; then, you end up buying high and sell it low as it will fall sharply!

Strong Word of Warning for the Newbies

Honest story of a trader who gambled with credit money on too good to be true projects, used robot trading and lost a lot.

Read: Not Another Fairytale Ending a Word of Warning

Summary: Don’t chase losses, don’t look for the next get rich scheme and don’t invest money that isn’t yours to start with. Basically, don’t ruin your life like me. If only I had just held.

This market is still nascent and is extremely volatile - price can fluctuate a lot. Don’t get into options and futures and use excess leverage; many traders have been wiped out with 30% drops and quick recoveries.

Don’t use credit money; no matter, how good this story is, buy with savings that you can afford to lose or experiment with.

Note to DOGE and Other Micro Cap Buyers

Don’t get carried away and buy just because others are buying

Crypto: WHAT - #3 - Note to DOGE Buyers

Final Thoughts

KISS: Keep it simple and sweet - Simple strategy for better sleep and low risk. Simply accumulate as much BTC/ETH as you can and HODL - forget about it for a few year! BTC/ETH have been returning around 160% every year; you will probably get 10x returns in 5-10 yrs.

You don’t have to put any money into mid, low cap or micro cap!

Goal: Get better sleep - what good is the money, when you can’t have mental peace?