HOW?: #2 - Crypto Macro Market Cycles

Macro view of crypto market and the price predictions

Understanding market cycles is the most important for any market, Consumer Cyclicals, Real Estate, Artificial intelligence, Blockchain to get in and get out at the right time. Holding for the long time doesn’t work in these markets for many.

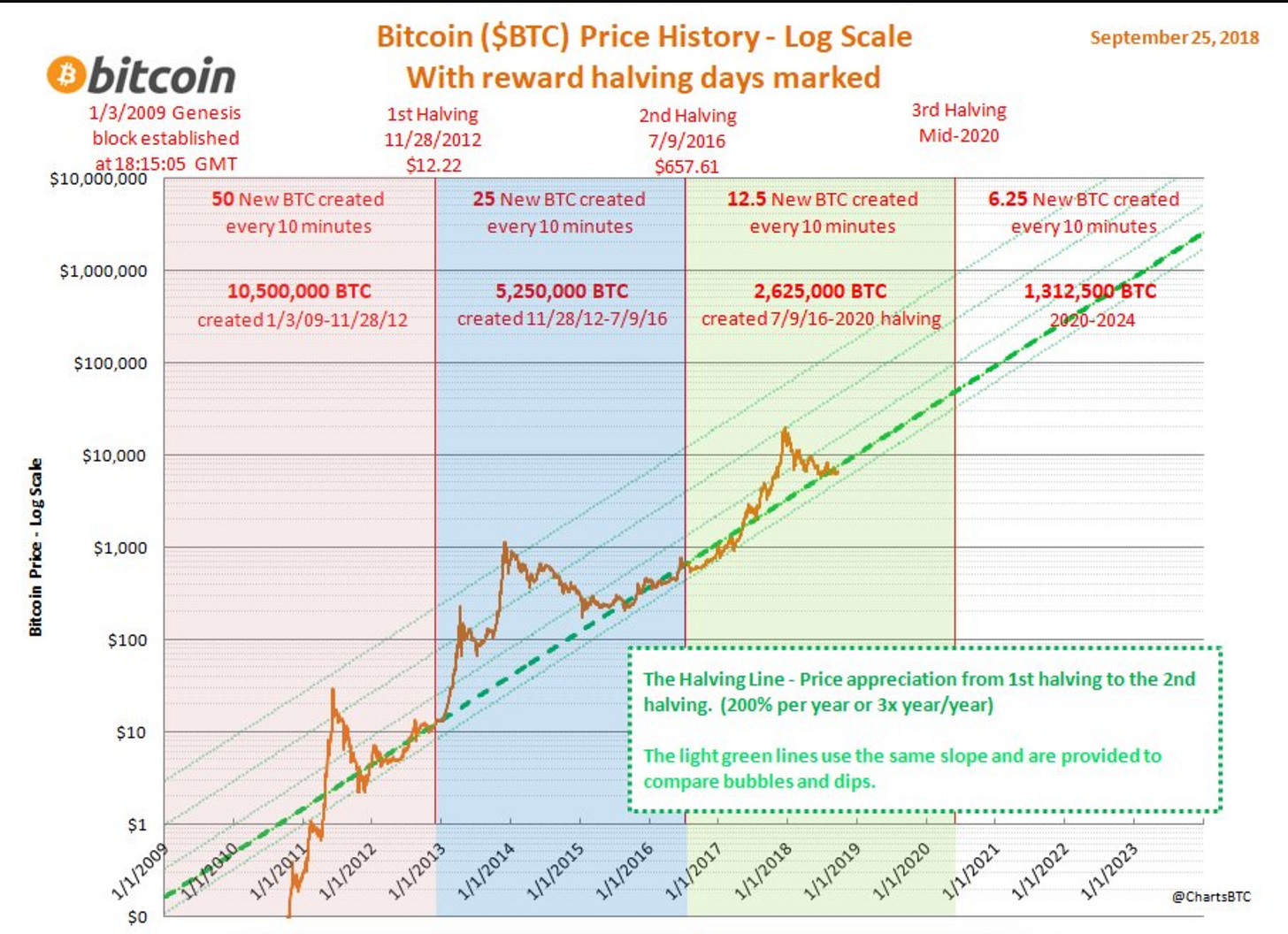

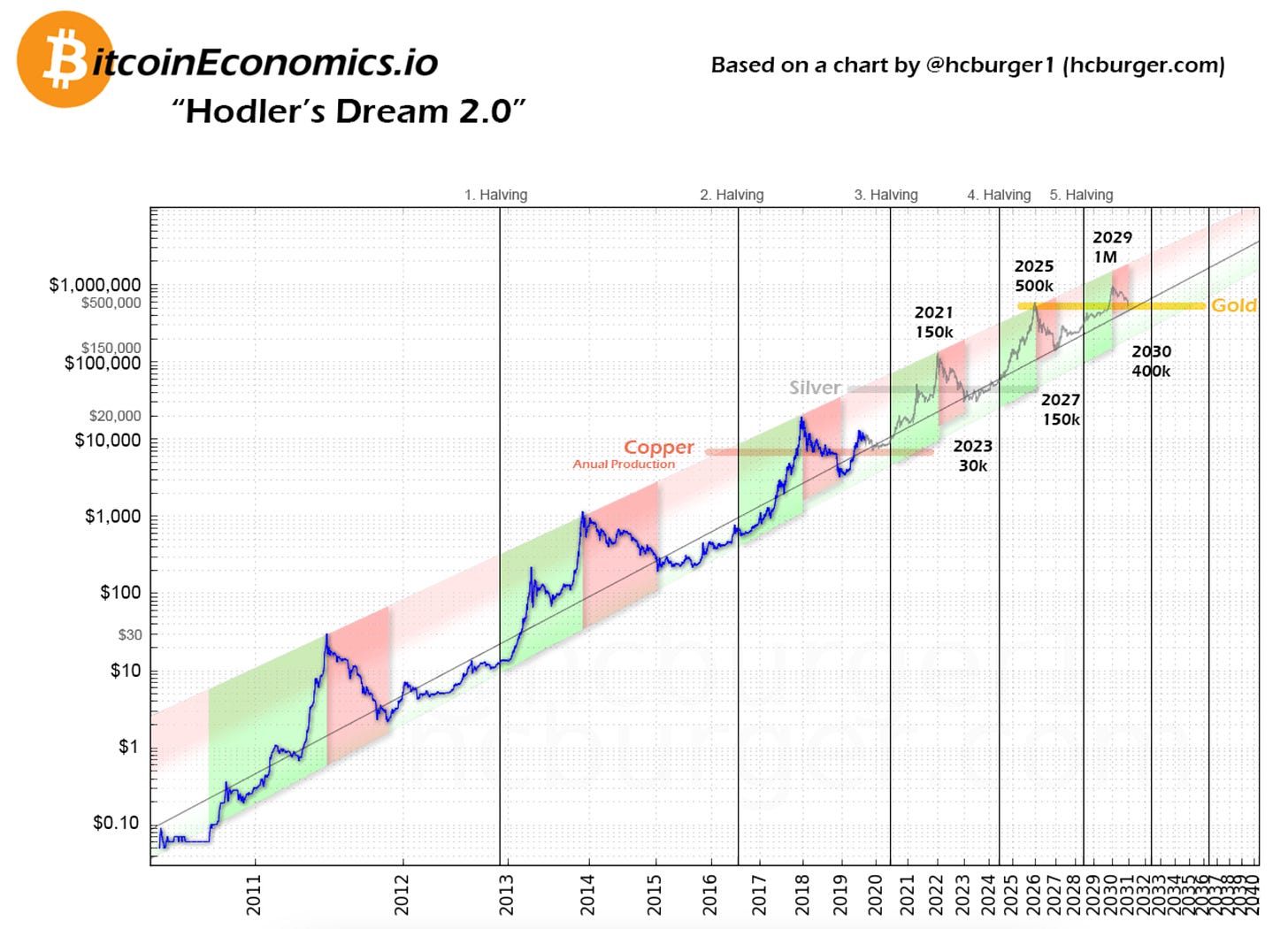

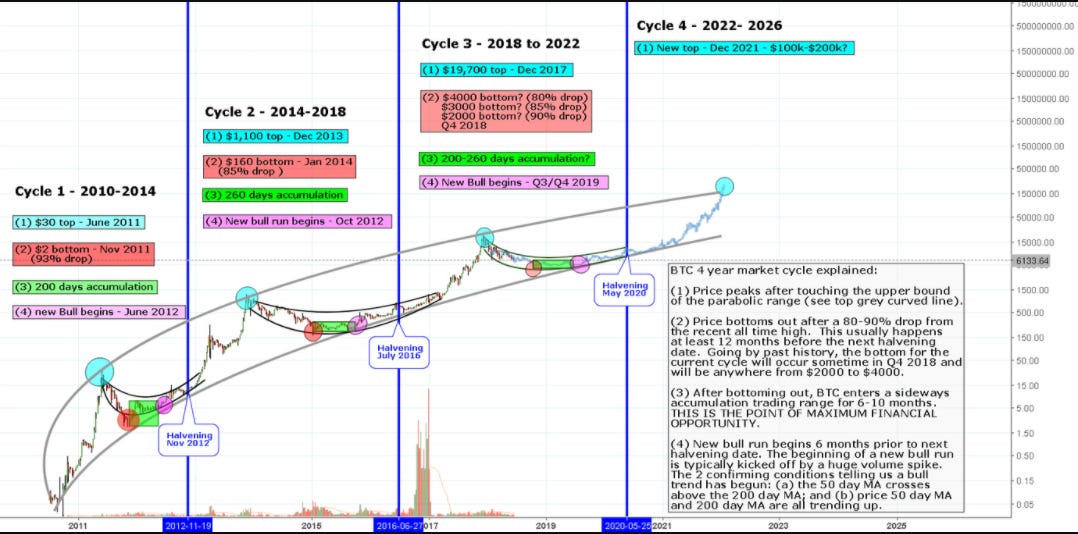

Crypto has its own unique cycles that are totally different from the rest of the assets due to Bitcoins halving events, that is the reason you didn’t hear anything in 2018 and 2019 but came back in 2020. These are super cycles.

Every 4 yrs Bitcoin mining reward halves; thus creating supply shortage and increasing demand. Since Bitcoin is the dominant Cypto, everything else moves in relation to it.

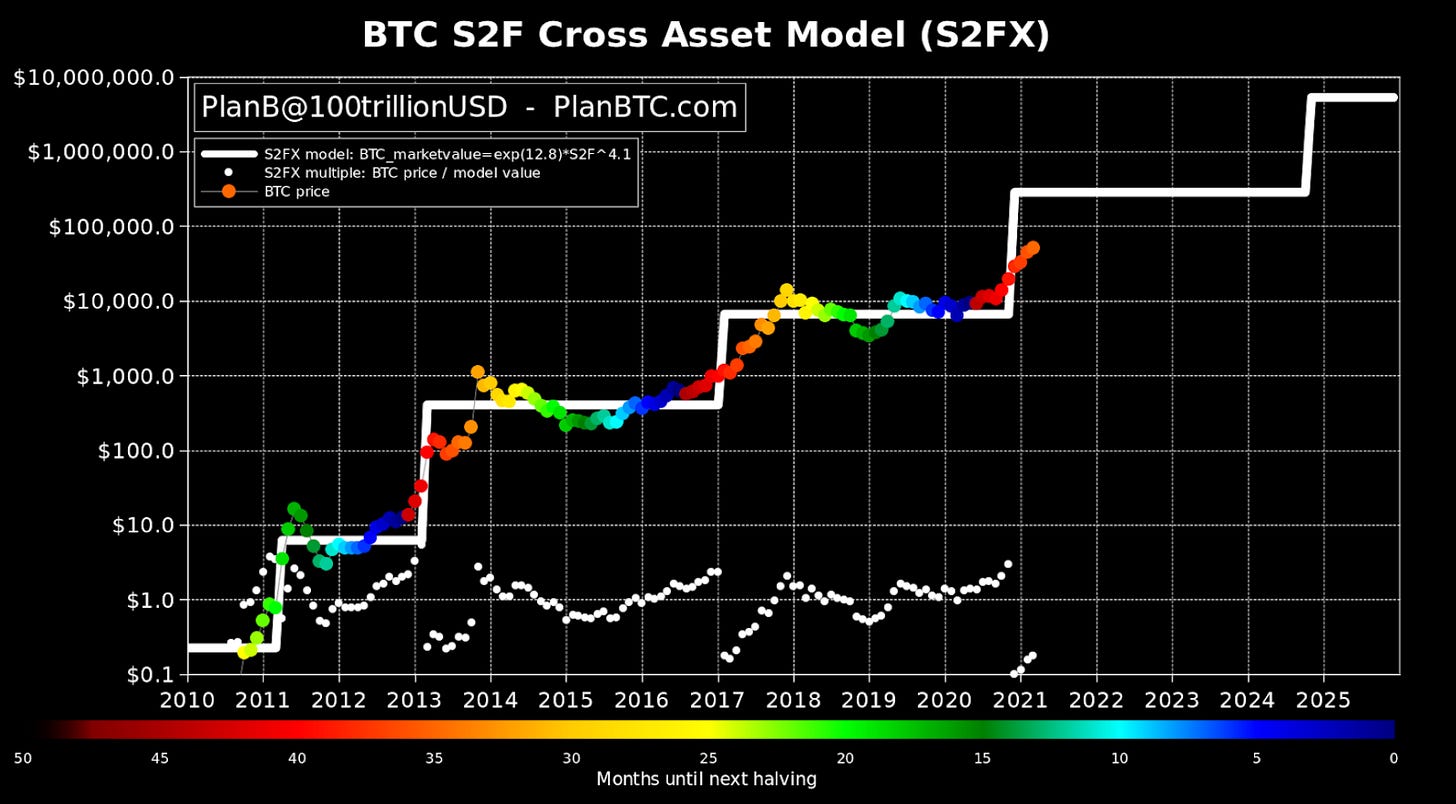

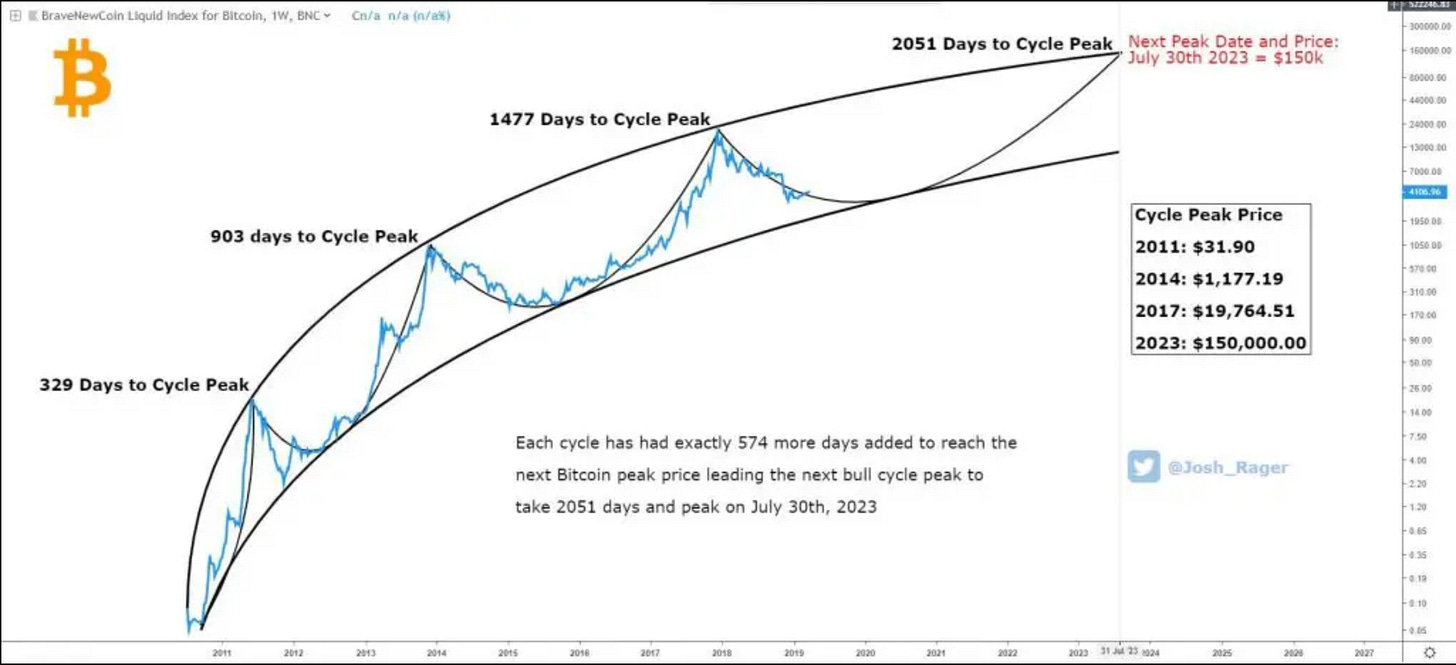

Long term logarithmic price predications based on the past cycles. Past is not an indication of the future, but it can give you clues. Unless something terribly goes wrong (read my Why blog on risks), things will follow the trend.

One of the best prediction models was created by Plan B based on asset models used for Gold and Silver. His predictions have been super accurate.

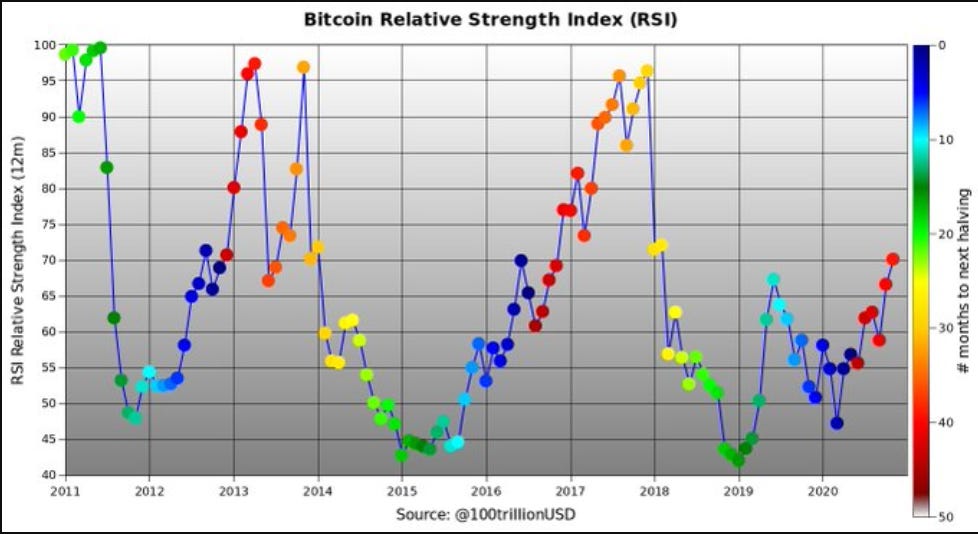

1 yr before halving starts the race. 1-2 yrs after halving is where money is made. 3rd year where consolidation/accumulation happens and some price correction.

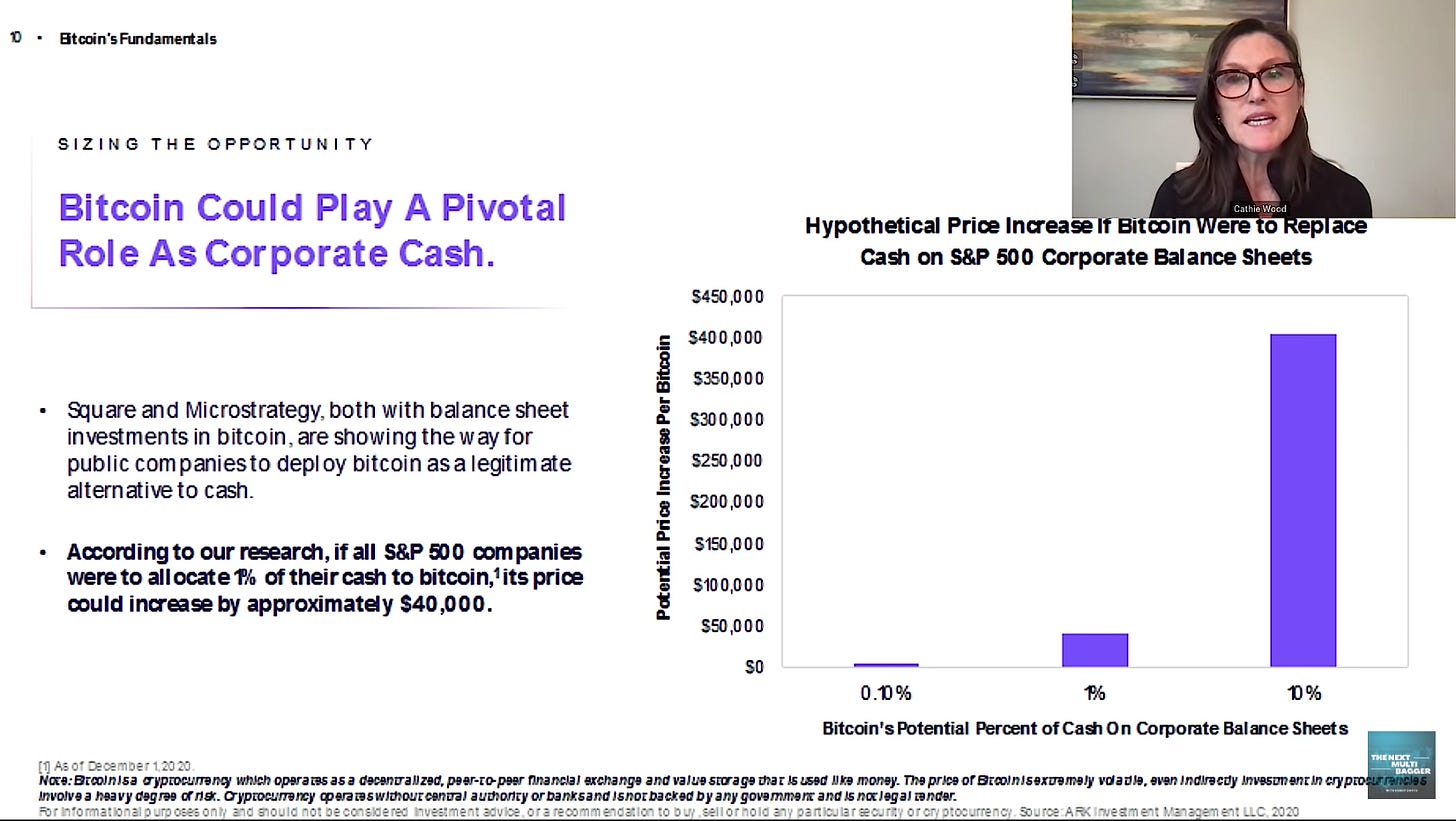

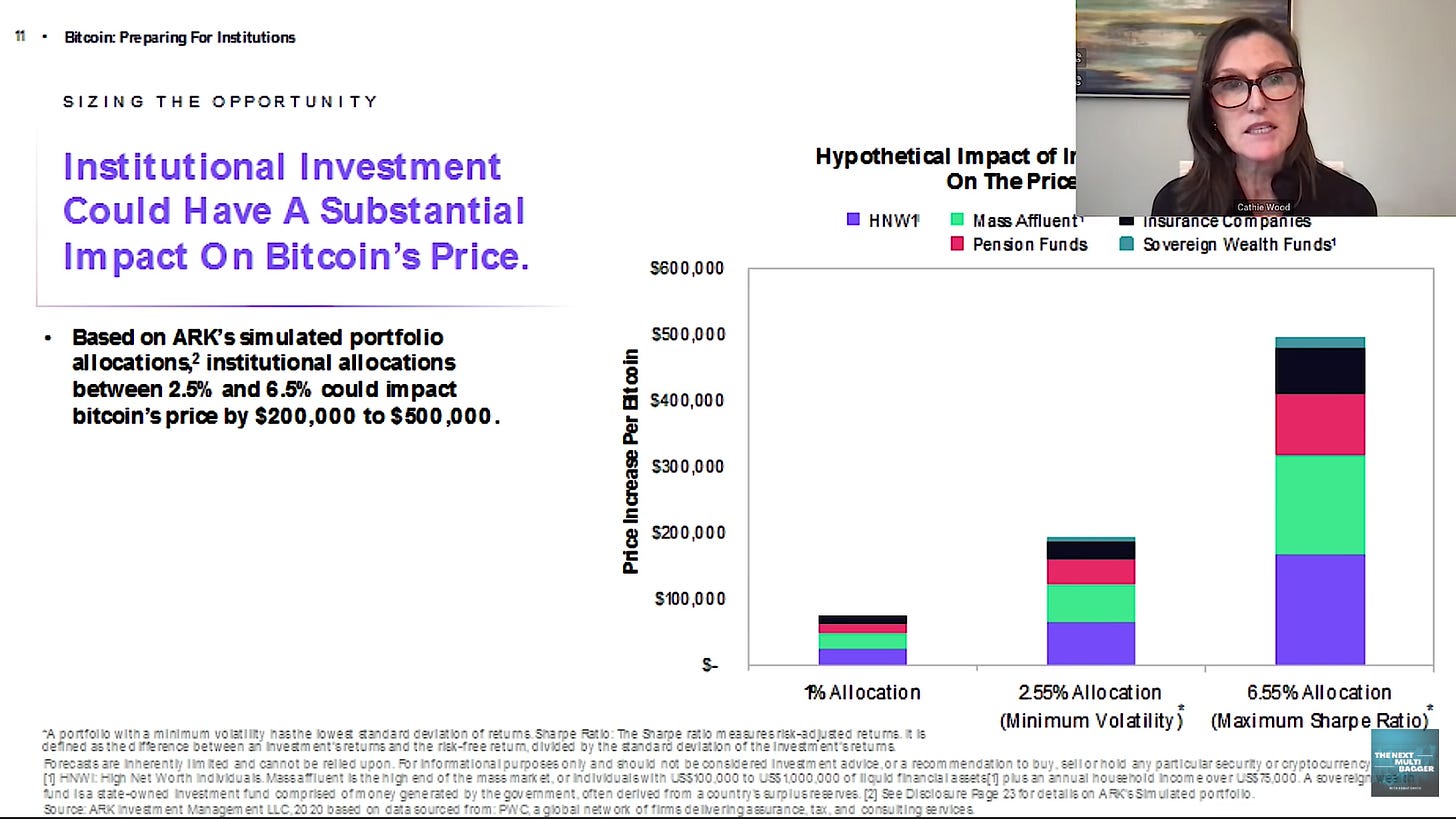

Given the mass adoption from S&P 500 companies and Banks Custoding - they each alone will add $500K price to the Bitcoin. This 3rd year may not see drop in price at all.

Next cycle boom may in Dec 2021. What do you think?

Or on July 30th 2023. Share your thoughts in the comments.

Here is a good view of how the demand/Relative Strength index (RSI) in relation to halving events.

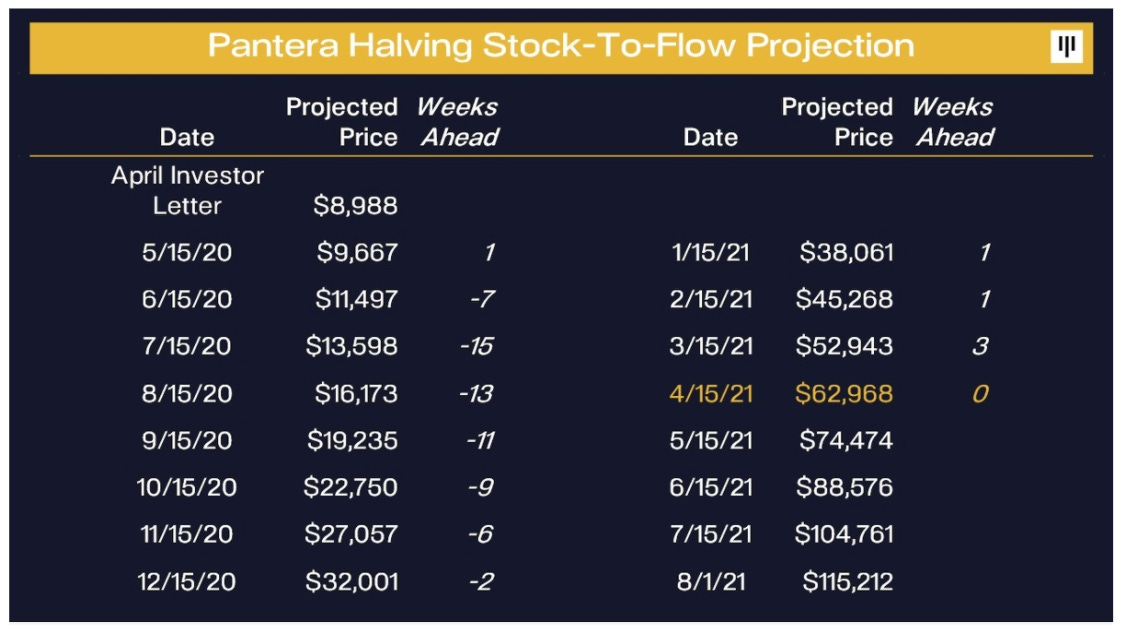

Pantera Capital predicted the prices for the past year and they have been damn accurate

Source: Pantera Capital

Now that you know macro cycles, we will learn more about how the markets work within Cypto in relation to Bitcoin.

Read: HOW?: #4 - Crypto Market Dynamics (coming soon)