WHY?: #1 - Once in a Generation Wealth Creation Opportunity, Don't Miss Out!

Learn about how to ride the crypto innovation wave

Case for Crypto

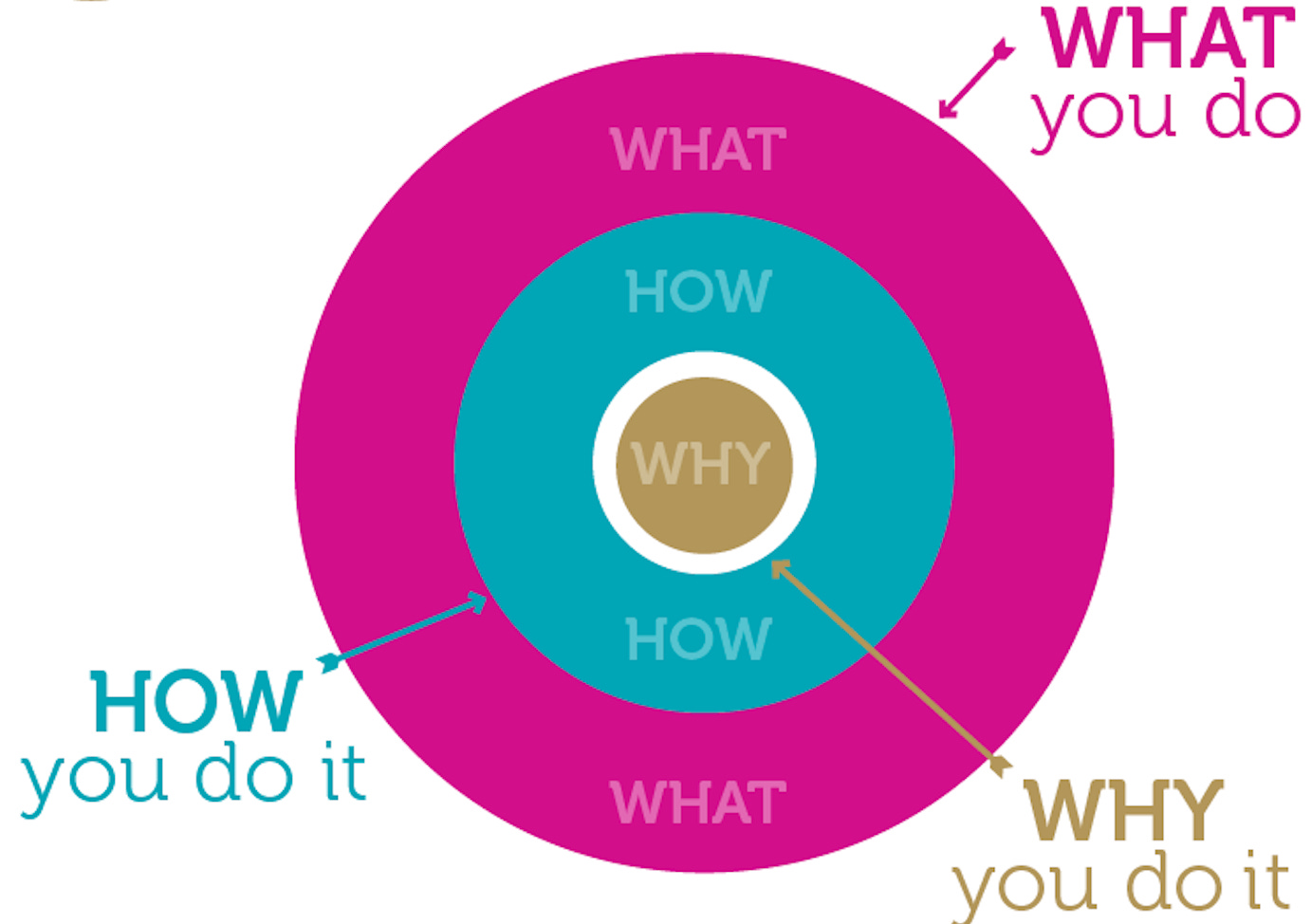

Welcome to Technology, Education, Policy Newsletter first post! In this post, I will walk you through how I kept myself ahead of the adoption curve. And make a case for WHY you should invest in crypto by bringing all the disparate information spread all over and bust some myths in the process. My goals is to make this content digestible for a common man/woman (no technical mumbo jumbo). Let’s discover the why together!

Source: thegoldengoose.com.au

I am truly fascinated by Blockchain and Artificial Intelligence (AI) technologies. Till now, I thought AI has a huge potential. Now, I subscribe to the notion that Blockchain has more potential to create a more equitable society than AI. (I will be posting on this specific topic)

I have been investing in Crypto since 2014 and have been blown away by the opportunities created by the blockchain for the common man, i.e, eliminating the middle man (brokers - banks, lenders, tv channels, cloud) in every aspect of our life & putting us ahead of the Venture Capitalists (VCs)/Investors; thus leading to a more egalitarian and equitable society.

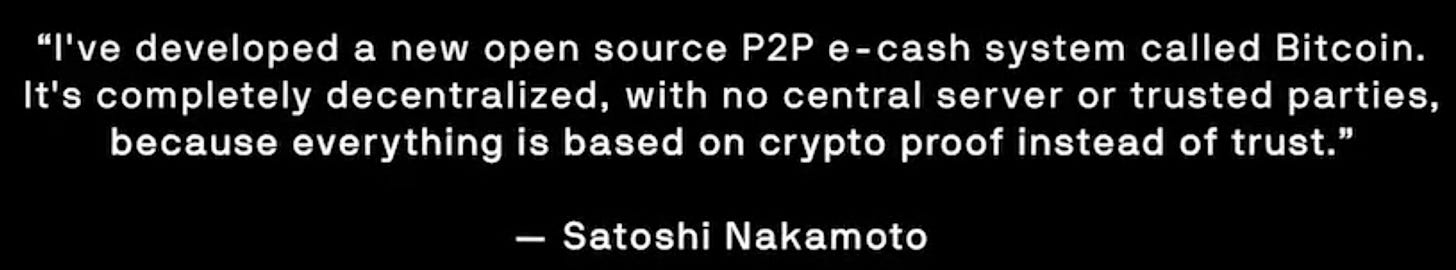

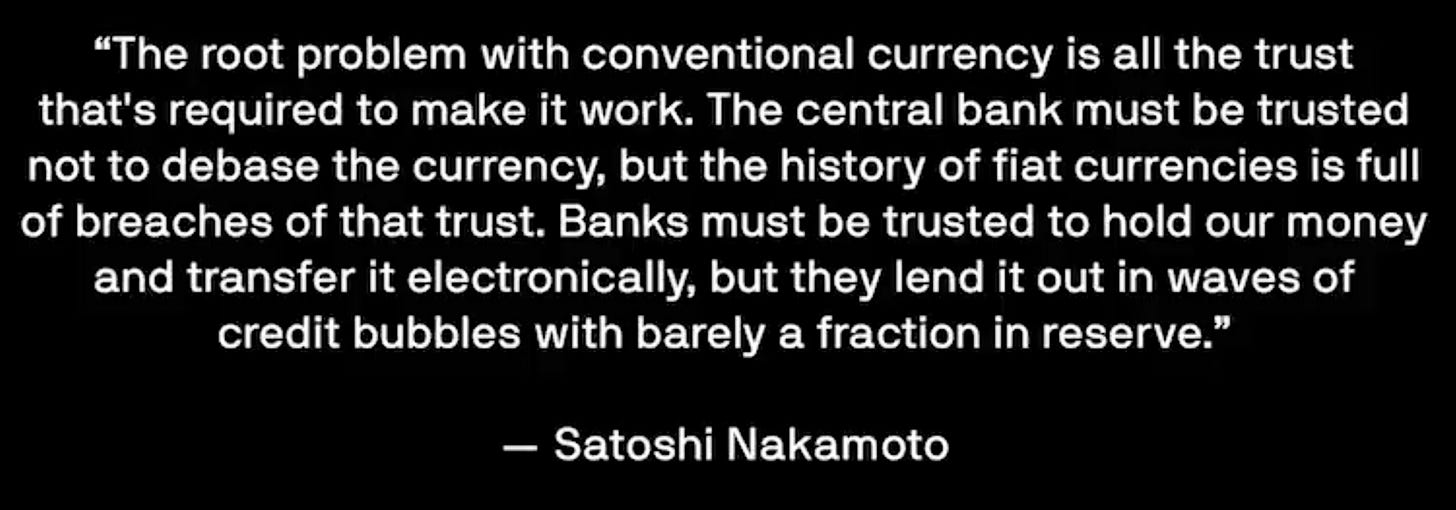

Fundamentally, Blockchain created trust between 2 parties that couldn’t trust each other before without a middle man. (Optional: Read the original white paper if you have time)

That is why, I call blockchain - “the common man protocol”. This is best thing ever happened to a common man (I will post a lot more on this). Thank you, Satoshi Nakamoto! The society owes a lot to you!

Read: Planting Bitcoin - Species - Dan Held

About me - Engineer, Entrepreneur, Hacker and Investor

I am a software engineer and an architect; I worked in FinTech for startups and large companies like Charles Schwab. I currently work at Google. I am an entrepreneur and had my own startup in the past.

UC Berkeley Executive MBA gave me necessary financial analytical skills and a keen eye to evaluate entrepreneurial ideas with conviction!

3 Bay Area Blockchain hackathons that I won gave me an in-depth technology chops. Teaching “Blockchain & Artificial Intelligence” for 2 yrs at UC Berkeley Exec Education to 500+ CEOs/VPs/Directors across the globe and interacting with them gave me much needed insights about the future of our world and society at large.

Learning from the Visionaries

Listening to great visionaries like Raoul Pal, Balaji Srinivasan (Former CTO of Coinbase), Naval Ravikant, Tim Ferris, and Robert Koyisaki has enlightened me and opened my eyes up to a whole new world of possibilities.

Raoul Paul (RealVision Finance TV CEO) talked about macro economic future. He invested most of his wealth in Crypto.

Robert Koyisaki (Author: Rich Dad, Poor Dad - best seller) - Talks about past and why you should buy Bitcoin

Naval Ravikat with Tim Ferris talked about crypto and why you should buy crypto

Balaji Srinivasan (Former CTO of Coinbase) with Tim Ferris talked about the future of world with blockchain

Here is a youtube play list to watch all!

Supply and Demand - Modeling the Price

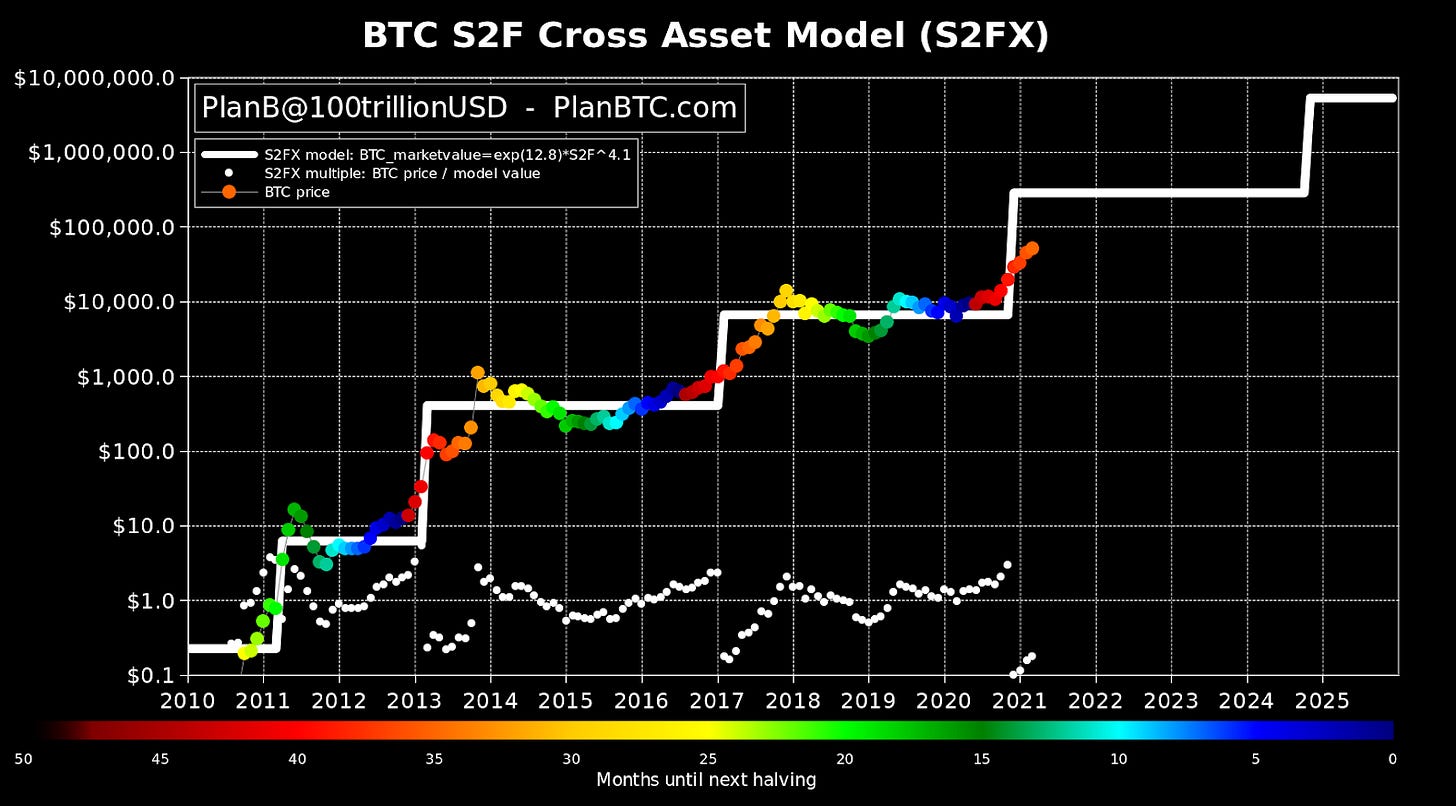

Further along, reading PlanB simply blew up my mind with his model with a target price of a single Bitcoin at $10M by 2026.

Many models in the past were used to predict Bitcoin price; only 1 model has withstood the test of time since 2010 - The stock to Flow (S2F) cross-asset model by PlanB @100trillionUSD. This is used for predicting the price of gold and silver; it has been pretty accurate in predicting the price of Bitcoin.

Real-time model: https://digitalik.net/btc/

Did your brain just explode, or are you calling the bullshit? Let’s digest this slowly.

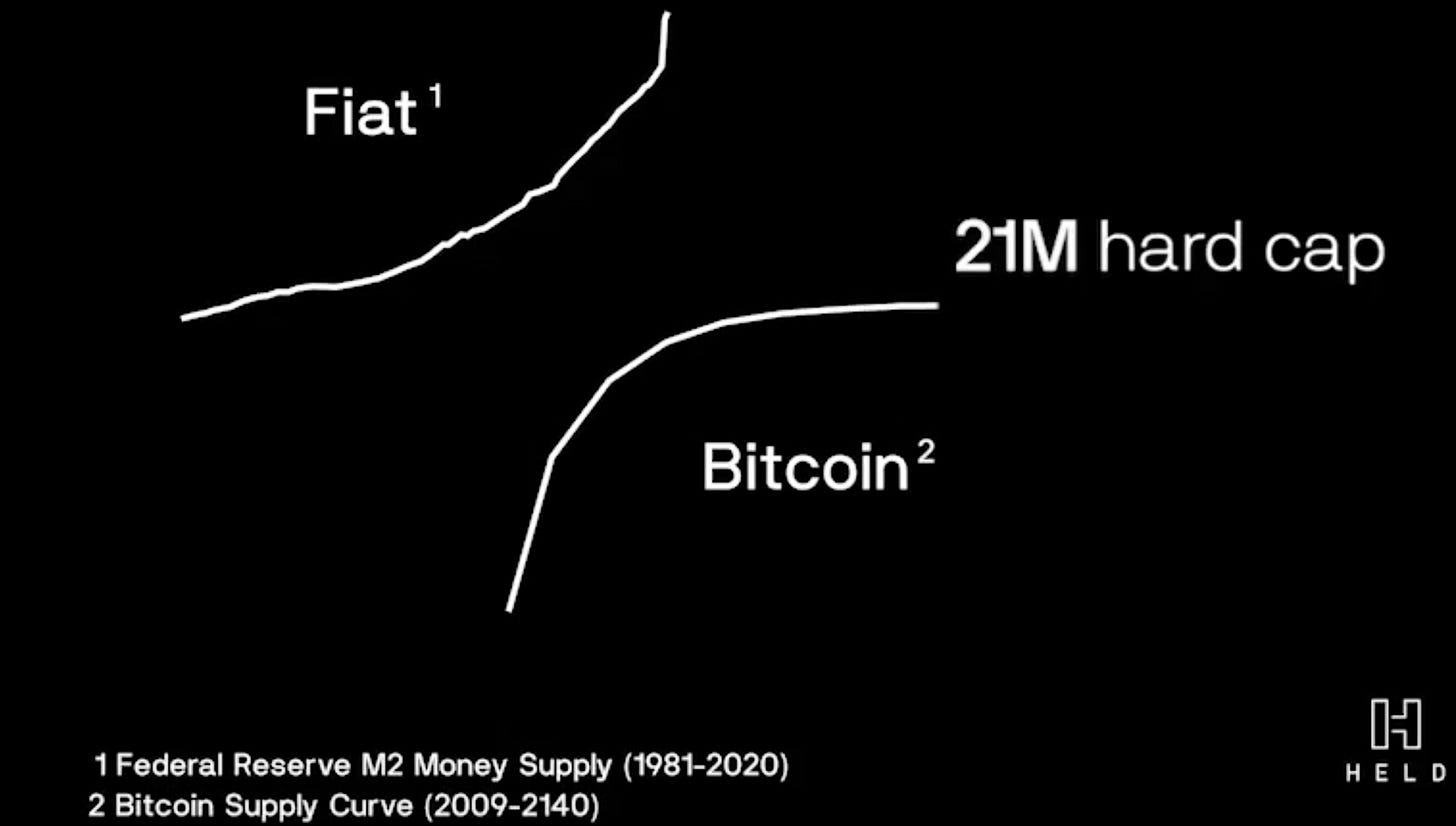

There can only be a maximum of 21 Million Bitcoins due to mathematical limitations in the blockchain software, which can never be changed! So far, in 2021, 18 million Bitcoins have been mined/produced. (Info: What is bitcoin mining?).

Let’s do Simple math - there are 7.5 Billion people on earth. Let’s just say that there are the top 1% of filthy rich people, i.e., 75 Million. If each of them decides to buy Bitcoin, the maximum a person can own is 0.28 BTC. Don’t forget the fact that there are so many coins that have been lost as many forgot their private keys!!!

Source: Bitcoin Will Dominate 21st Century, Has Zero Threats to Existence: Michael Saylors

“Bitcoin is the fastest growing, most disruptive force in the world right now, objectively speaking. It went from $0 – $1 trillion in 12 years. That makes it the most disruptive tech in your lifetime, in my lifetime – more disruptive than Amazon, Apple, Facebook and Google, more disruptive than anything in our lifetime.”

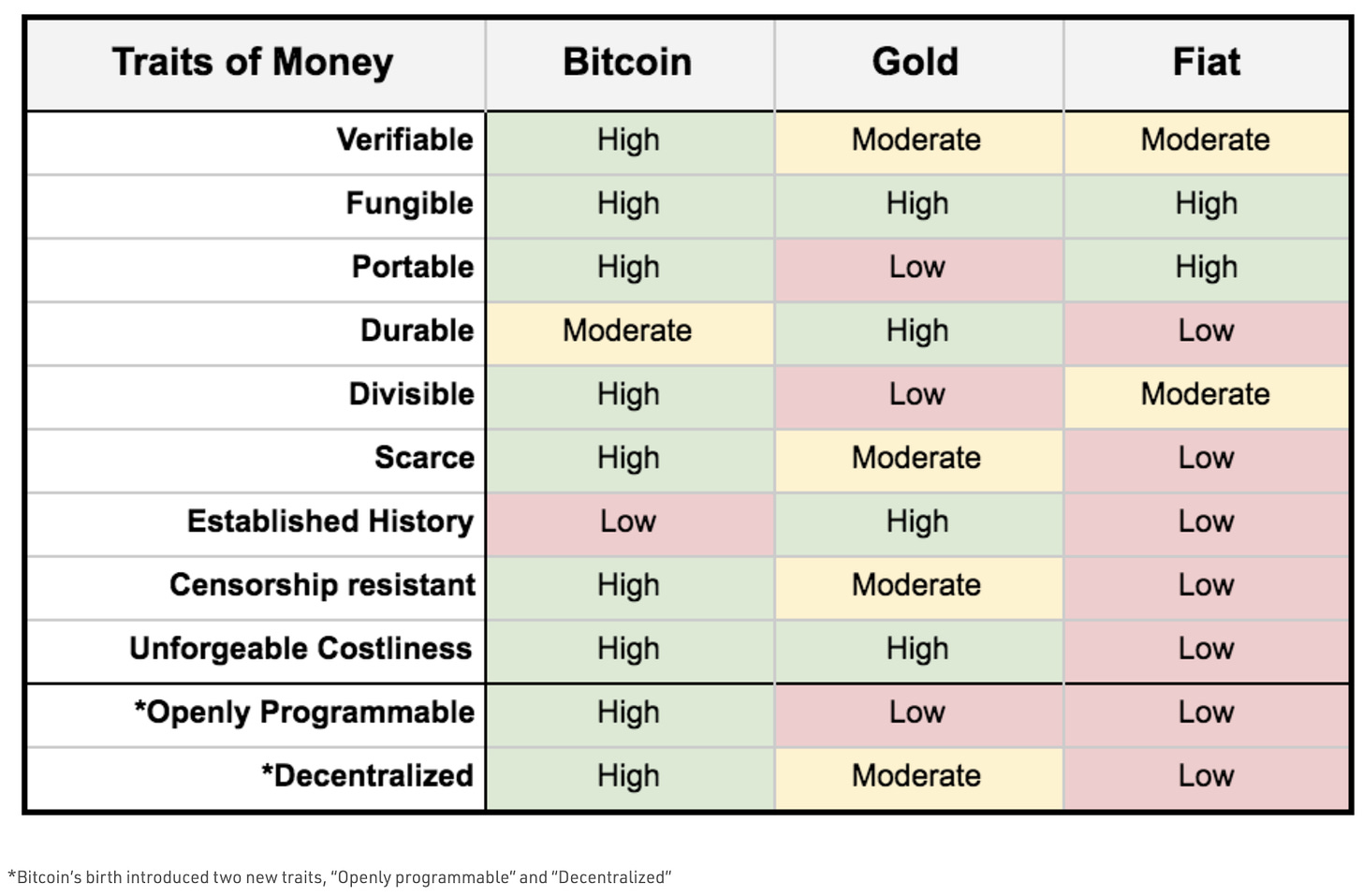

The CEO also says there’s a common misconception that Bitcoin should be viewed as a currency, and therefore could compete with national currencies. Saylor notes that it is more accurately described as a crypto asset, and as such poses much less of a threat to fiat currencies than stablecoins.

“Once you understand [that Bitcoin is] a crypto asset, then you understand it’s not competing with the [US] dollar and the euro. [Bitcoin is] competing with gold and silver and ETFs (exchange-traded funds) and stocks… Jerome Powell (Federal Reserve Chair) said two weeks ago, yeah it’s digital gold…

[Large governments are] going to be concerned with stablecoins, like the ability to move billions of dollars of euros on a crypto rail, or the ability to move billions of dollars of US dollars on a crypto rail. That’s going to draw the interest of the banks because currency is the provenance of the bankers and the government. And they’re going to be concerned about controlling their currency.”

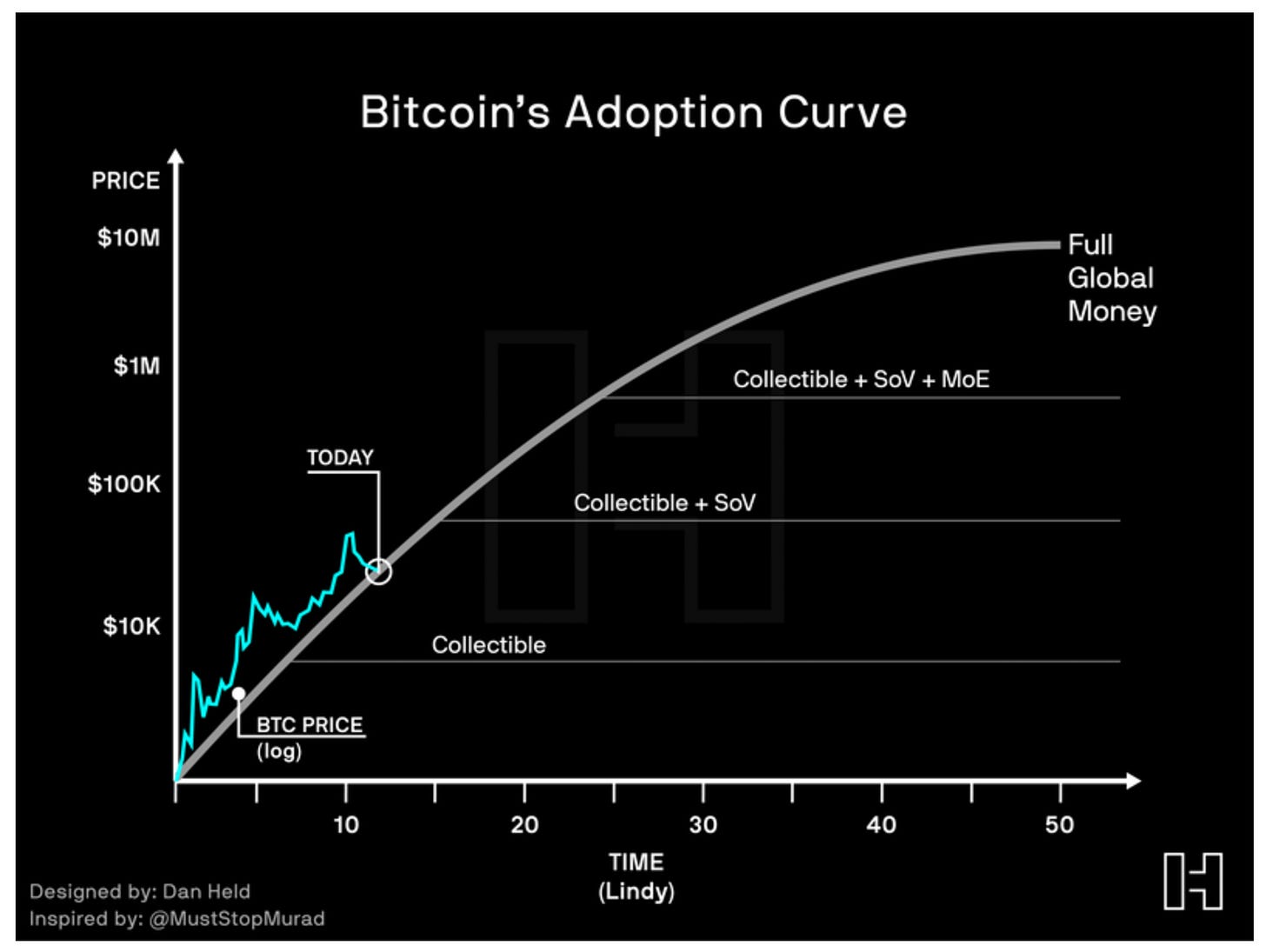

Adoption Curve

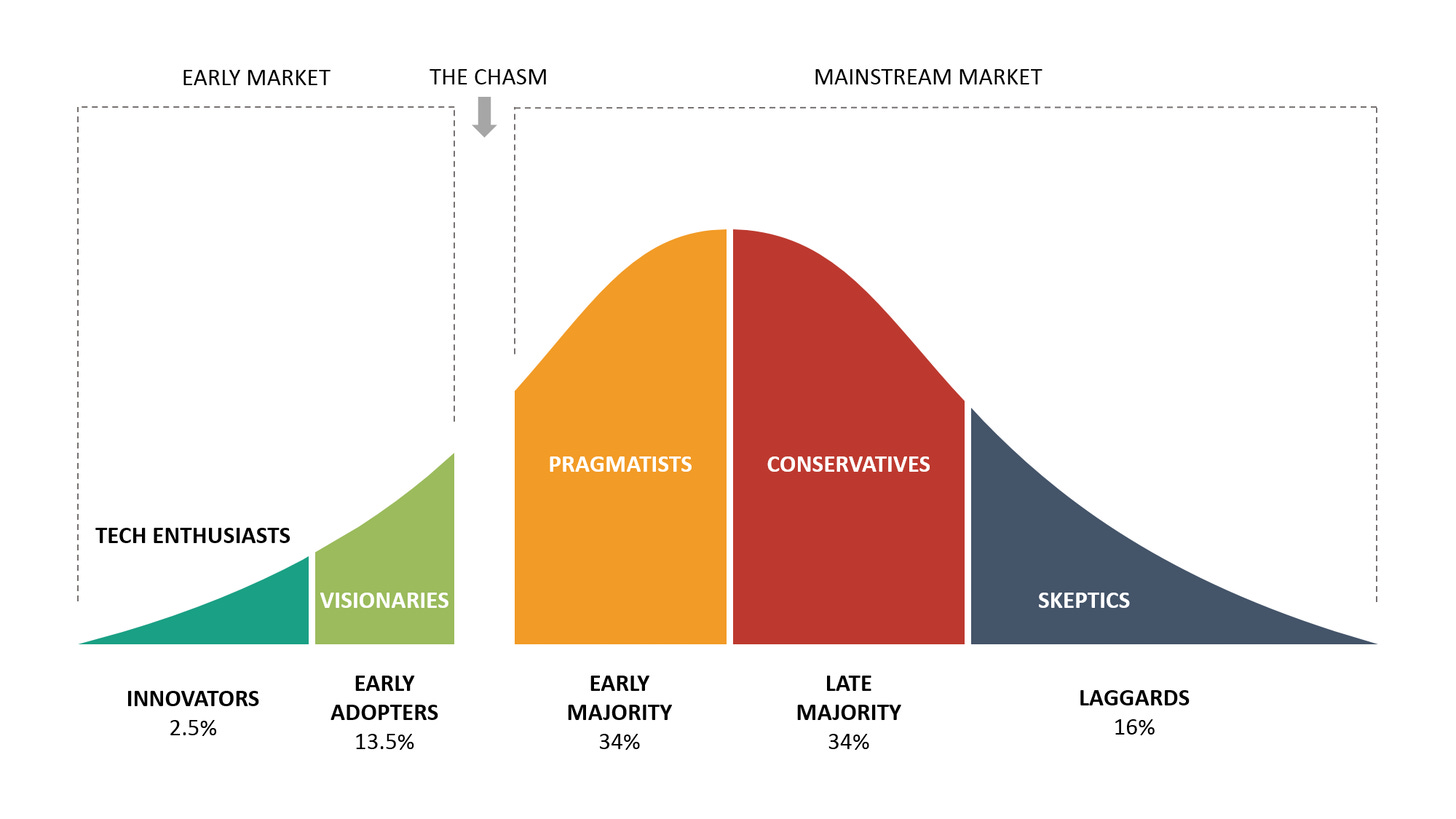

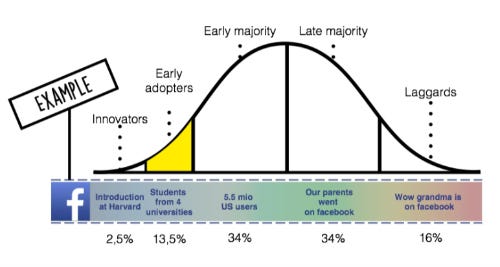

Let’s face it: We are the early adopters! Understanding crypto and investing in it is not easy, and that is why many people are not yet investing.

If you have waited for first iPhone/Pixel in a line at 4pm in the morning - you are the innovator. Early adopters are willing to go the extra mile to get over resistance to reap early rewards.

Source: https://www.helloiota.com/articles/technology-adoption

The opportunity to make maximum profit with little less risk is in the “Early Adopter Zone - Visionaries“. That is where we are now - visionaries are getting into Crypto.

What if the rest of the 99% of population (Early/Late Majority and Laggards) wants to own the same scarce resource This truly is a “Once in a generation opportunity to create massive wealth”!

Blockchain is an Open Ledger - Disappearing Black Market

The blockchain transaction ledger is stored on all the validator nodes (computers that validate transactions on the network). Exact copies of transactions (with the sender's and receiver's public keys, the amount, and the fees paid) are replicated on all the machines. This means anyone can see/trace all the transactions made on the blockchains from the beginning.

Blockchains are pseudonymous (like an alias that may be traceable to an actual person) - public keys/addresses can’t be attributed to a person. Only the person owning the private key can prove that they own the public key without revealing the private key. This is also known as signing.

The government used blockchain to trace stolen coins back in 2016.

In April 2021, Feds Arrested an Alleged $336M Bitcoin-Laundering Kingpin. Fed used decade decade-long trail of transactions to catch him.

Former CIA Acting Director Michael Morell recently authored a report examining Bitcoin's use in illicit finance. In short, he found that the illicit use of Bitcoin is far less than many people assume, and probably even a significantly smaller share of the Bitcoin economy than the illicit use of dollars is vs global GDP.

If Bitcoin and ETH blockchain are transparent ledgers, do you think criminals want to use them? Moreover, the market's other coins (Monero and Zcash) try to bring complete anonymity. Maybe they will be used for this, not BTC or ETH.

Myth busted! - more transparent than current banking ledgers! How much black money is in Swiss banks or the Cayman Islands today?

Energy Usage - Why We Need Proof of Work?

Bitcoin uses energy because of the “Proof of Work” algorithm that validators (transaction block creators, i.e., miners) have to run. They have to solve a mathematical problem (number multiplication with a random number to generate a final number of 4 or 5 leading zeros) using only brute force, i.e., no shortcuts. In reality, many computers pool together and solve the problem to create a block of transactions. (As computing power increases, the Bitcoin network adjusts the puzzle complexity to ensure that a block is generated approximately every 10 mins; hence, 10 min transaction processing time. This also ensures that supercomputers can’t just take over the network). For validating, they get a block reward of 6.5 BTC today. Every 4 years, this reward will become half. Because these nodes must prove that they used raw computing power, it is called “Proof of Work.”

Many blockchains have moved to “Proof of Stake,” which requires minimal energy. In this case, a validator node will just deposit/stake millions of dollars, pledging that they will not commit fraud. If any node tries to include fake transactions, other nodes detect and penalize the lousy validator, taking away their deposit; hence, it is in their best interest not to commit fraud. This not only reduces energy use but also speeds up transaction throughput. Sounds like a no-brainer to move to this, right?

Ethereum network version 2 plans to move to this to scale its network; however, there is a massive opposition to this. The whole idea of blockchain is not to give control to a central authority like a government or a dictator. Which algorithms would be easier for a government to implement and take over the network by starting more than 51% of their validator nodes?

The energy consumption of the crypto is much less (~40% less) than the energy used by the financial institutions it is going to replace with DeFi (Decentralized finance).

Moreover, it is actually suitable for renewable energy grids. All validator nodes need is an internet connection and power. They can also be turned off and on whenever they want. So, most mining operations are set up near cheap energy sources. Since renewable energy has ups and downs and no excellent storage solutions, the excess energy must be used immediately. These validator nodes can be the last leg of the customers, i.e., increasing funding for renewable ecosystems.

Myth busted - it is suitable for renewable energy, not bad! (Additional - Youtube Fact Check)

Can Other Coins Replace Bitcoin? (Ex: DOGE)

Currently, there are around 6000 coins in the market; many more have started and died. Bitcoin has the first-mover advantage and amassed colossal adoption. Many software systems (payment, ATMs, and many more) are integrated with the Bitcoin blockchain. These all required significant investments from these adopters.

Since it has a maximum supply, it is considered a digital gold to fight against inflation. People from countries like Argentina (which has massive inflation) are buying Bitcoin.

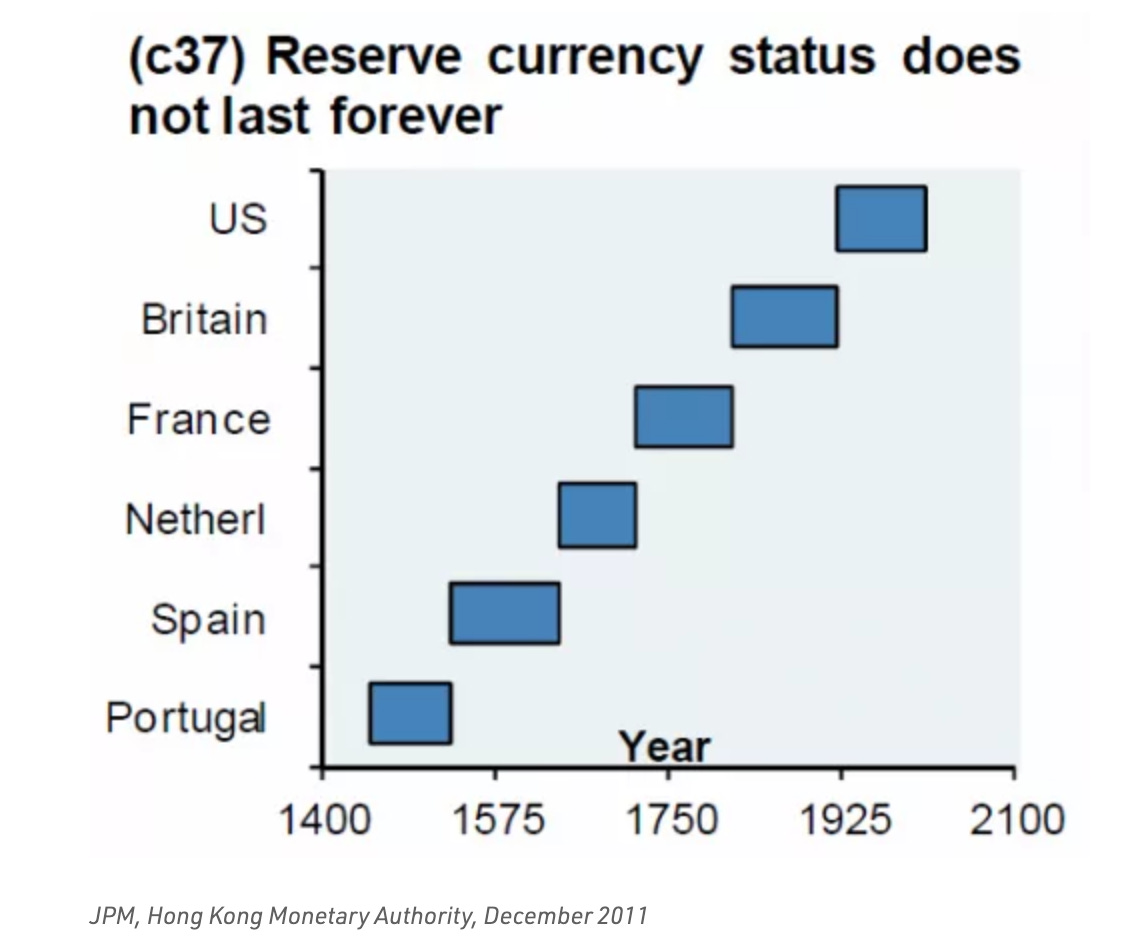

The Lindy effect is a theorized phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age. Thus, the Lindy effect proposes the longer a period something has survived to exist or be used in the present, it is also likely to have a longer remaining life expectancy. Longevity implies a resistance to change, obsolescence or competition and greater odds of continued existence into the future.

Bitcoin leads the pack with a $1T market cap as of 2021; it is hard to replace this. Many tokens in the past replicated the Bitcoin max supply; however, none survived. Bitcoin withstood the test of time for the past 11+ years; there is a high probability that it is here to stay and be the #1 coin.

Not many other coins have the same scarce trait, most importantly, along with adoption and first mover advantage!

Old Visionaries Became Laggards - Good that We Can Still Afford to Buy BTC

I like Warren Buffet and other visionaries of the past. They only invest in the things that they understand. That is how it should be. It is hard for them to grasp this new technology and overcome their firm beliefs in physical assets. It will be hard for them to get over it. Not only Warren Buffet but so many other wildly successful traditional investors can’t get over this barrier.

Good Debate for and against (traditional video) - Real Vision Finance TV Interview

This is normal for companies, too. For example, Kodak invented excellent B&W film. When the color film came out, they said who would use less quality color film when you can get the best quality B&W film. They didn’t invest, and you know the rest of the history!

This is good for the common man like us that likes of Warren Buffet haven’t invested in crypto. Otherwise, BTC price would have been very high for us to get in. That is why we need non-believers for us to accumulate more.

Companies Came Before Institutional Investors - A Rare Unexpected Case

No one expected companies like MicroStrategy Tesla to invest money in crypto. Everyone was expecting investment firms and hedge funds to jump in first. However, Michael Saylor (@michael_saylor), MicroStrategy CEO (owns $4.5B BTC), changed all that in Oct 2020 with his online conference (200k Execs attended compared to a few thousand every year). (Read: ).

Most tech companies amassed massive amounts of cash and sometimes don’t have other opportunities to invest or expand their business. He made a case that investing in Bitcoin gave them 160% returns every year, which is the best way to provide higher returns for its investors. Many listened, and MicroStrategy stock shot up as they had 90,000 BTC that was purchased at a low price. :-)

Companies across the globe invested $64B in coins https://bitcointreasuries.org/

A recent survey by Forbes found that 25% of the companies plan to invest in crypto in 2021 compared to 1% in 2020. As per Cathywood, if companies invest only 5% of their cash, that would bring trillions into Bitcoin ($1T market cap) and ETH ($380B market cap). Will this event alone double or triple the price of BTC ETH?

Crypto Regulation Risk - Low to Medium Risk

Regulators worldwide have already acknowledged that it is hard to ban Crypto as it is a snake with 1000 heads, i.e., no central point exists. If you ban one geography, it will simply move to other areas and survive with minimal disruption. A classic example is India, which is trying to ban it. All the nodes and the developers are simply moving operations to other countries. And most of the Indians are still buying crypto through Binance and other exchanges.

When you know you can’t stop it, you try to control it as much as possible. That is what regulators are doing. They partially admitted by creating IRS taxing rules - treat Crypto like any other asset - stocks and pay capital gains tax. This reduces the risk of altogether banning Crypto in the US.

Canada already approved several ETFs for both BTC and ETH. Ethiopian South Korean governments are already using blockchain for some of the governance.

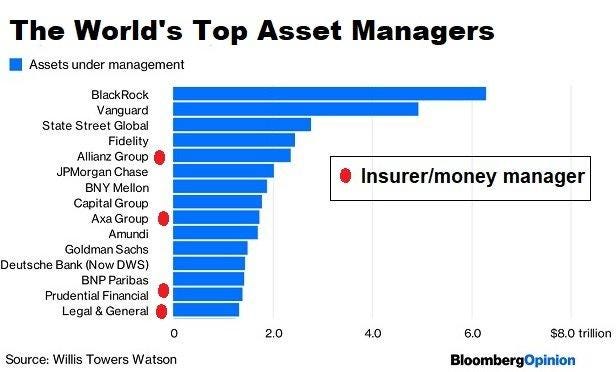

Blackrock (UK) is the #1 investment company in the world with an AUM of $9T and is already testing the waters. Other institutions are paying attention as their wealthy customers are asking for it. Morgan Stanley ($3.2T) and JP Morgan Chase (AUM $1.9T) are under tremendous pressure to create ETFs. They all applied for ETFs to the SEC and will most likely be accepted. Guess who influences SEC? These same financial institutions Executives becomes advisors and lobbyists when they retire.

Cathy Wood from Ark Investments said that if institutions move 5% of their portfolio to Crypto, it alone will add $500k price to BTC and they will. Mind blown yet??

You should try to get in before these ETFs will be out. Swift action matters. Read my “Tools & Discounts blog to get started right now“.

Source: https://seekingalpha.com/article/4217263-asset-managers-you-are-not-growing-you-are-dying

Moreover, Gary Gensler, the US Securities and Exchange Commission (SEC) chair under Biden. He is a professor at MIT and a senior advisor to the MIT media lab Digital Currency Initiative. He is already talking about bringing regulations that bring credibility to the industry. He is the best thing a crypto community can ever get in policy-making to make it succeed.

Additionally, many of our senators own crypto themselves. Do you think they will kill their own investments?

Security Risks - Real

This is one of the significant risks.

We may find significant security issues in the blockchain. However, the technology has been there for 12 years and has improved. Unlike traditional companies, the crypto developer community reacts fast and fixes things within 24 hours.

Another risk is someone stealing your investments by hacking your private keys or exchanges being hacked. This is becoming less of an issue as crypto exchanges are becoming more secure and people are becoming more aware of how to store keys - tricky wallets, 2FA, etc. As long as you can protect your keys, you are good.

Additionally, once ETFs are out, you can simply transition to those to reduce your risk further.

Quantum Computing - Unknown Risk

Quantum computing expert Andrew Fursman believes that Bitcoin could one day be at the mercy of quantum attacks as computers grow more powerful.

“It’s mathematically proven that if you have a device that looks like the kind of quantum computers that people want to build, then you will be capable of decrypting this information significantly better than could ever be possible with classical devices.”

I am not too worried about this as quantum computing doesn’t appear in a single day; it will be over time. The crypto community reacts quickly; they can adapt to quantum computing attack risk, use quantum computing to create a better cryptographic key, migrate past transactions (blocks), and update public/private keys.

Final Case for Bitcoin

Still not convinced? Read this https://casebitcoin.com/

In the future, we can’t talk about owning a Bitcoin; you will be laughed at; we can talk only about owning a satoshi. :-)

A satoshi is the smallest unit of a bitcoin, equivalent to 100 millionth of a bitcoin. Bitcoins can be split into smaller units to ease and facilitate smaller transactions. The satoshi was named after the founder, or founders, of bitcoin, known as Satoshi Nakamoto.

Bitcoin is just the tip of the iceberg. It is only 1 of the tokens out of 6000 tokens that are trying to solve different problems.

Currently, I am working on ideas for starting a company in the crypto space. So, I spent a lot of time researching many tokens to understand the business problems they are solving. I realized there is so much potential for 10x-100x gains in this space, i.e., much more than Bitcoin!!!

My life’s motto is “Learn, Earn and Return”

Given that I had so much information and the once-in-a-lifetime opportunity to make money, I decided to share my thoughts with friends & family so that they wouldn’t miss out. Now, I am extending this knowledge to other like-minded people like you.

Here is the market sentiment in crypto TODAY: Latest Crypto Fear & Greed Index

Are you a “Early Adopter or Visionary“ or a “Late Majority or Laggard?“.

I will teach you how to become a “Visionary” with the right information. Sign up now so that you don’t miss out on the opportunity!

In the meantime, tell your friends!